"How to Secure Car Loans with a Low Credit Score: Tips and Strategies"

#### Low Credit ScoreA low credit score typically indicates that an individual has a history of financial mismanagement or has not established a robust cred……

#### Low Credit Score

A low credit score typically indicates that an individual has a history of financial mismanagement or has not established a robust credit history. This can result from missed payments, high credit utilization, or even too many credit inquiries. For many, a low credit score can feel like a significant barrier, especially when it comes to securing loans, including car loans.

#### Car Loans

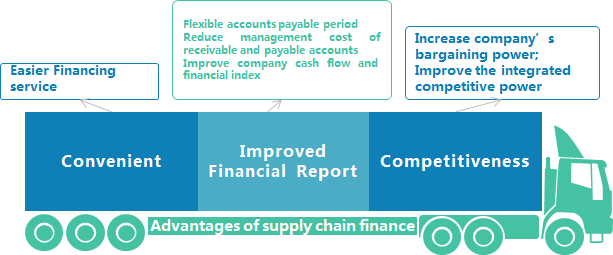

Car loans are a specific type of financing used to purchase a vehicle. They can come in various forms, such as secured loans, where the car itself acts as collateral, or unsecured loans, which do not require collateral but usually come with higher interest rates. Understanding how car loans work is crucial for anyone looking to buy a vehicle, particularly those with a low credit score.

### Detailed Description

Securing a car loan with a low credit score can be challenging, but it's not impossible. Many lenders are willing to work with individuals who have less-than-perfect credit, albeit often at a higher interest rate. Here are some effective strategies to consider when seeking car loans with a low credit score.

First, it's essential to understand your credit score and the factors that contribute to it. Credit scores typically range from 300 to 850, with scores below 580 considered poor. Before applying for a car loan, check your credit report for errors or discrepancies that could be negatively impacting your score. If you find any inaccuracies, dispute them with the credit bureau to potentially improve your score.

Next, consider working on improving your credit score before applying for a loan. This could involve paying down existing debts, making timely payments on current obligations, and reducing your credit utilization ratio. Even small improvements in your credit score can lead to better loan terms and lower interest rates.

Another option is to seek pre-approval from various lenders. Many financial institutions offer pre-approval processes that allow you to see what loan amounts and interest rates you qualify for before formally applying. This can give you a clearer picture of your options and help you avoid hard inquiries on your credit report, which can further lower your score.

Additionally, consider reaching out to credit unions or community banks. These institutions often have more flexible lending criteria compared to larger banks and may be more willing to work with borrowers with low credit scores. They may also offer lower interest rates and better terms, making them a viable option for those in need of car loans.

It's also wise to explore co-signing options. If you have a family member or friend with a strong credit score, they may be willing to co-sign your loan. This can significantly improve your chances of approval and may even result in better interest rates. However, it's crucial to understand that the co-signer is equally responsible for the loan, and any missed payments will impact their credit as well.

Lastly, be prepared to make a larger down payment. A substantial down payment can reduce the amount you need to borrow, making you a less risky investment for lenders. This can also help you secure a loan despite having a low credit score.

In conclusion, while having a low credit score can complicate the process of obtaining car loans, it doesn't make it impossible. By understanding your credit situation, improving your score, seeking pre-approval, exploring alternative lenders, considering co-signers, and making a larger down payment, you can increase your chances of securing the financing you need for your vehicle.