"Unlock Your Dream Home: The Ultimate Guide to Pre Approval of Home Loan"

Guide or Summary:Understanding Pre Approval of Home LoanThe Benefits of Pre Approval of Home LoanHow to Obtain Pre Approval of Home LoanCommon Mistakes to A……

Guide or Summary:

- Understanding Pre Approval of Home Loan

- The Benefits of Pre Approval of Home Loan

- How to Obtain Pre Approval of Home Loan

- Common Mistakes to Avoid During Pre Approval of Home Loan

- Conclusion: The Importance of Pre Approval of Home Loan

Understanding Pre Approval of Home Loan

Pre approval of home loan is a crucial step in the home buying process that can significantly enhance your chances of securing the perfect property. This process involves a lender evaluating your financial situation and determining how much they are willing to lend you before you start house hunting. By obtaining a pre-approval, you gain a clear understanding of your budget, which allows you to make informed decisions and act quickly when you find a home that meets your needs.

The Benefits of Pre Approval of Home Loan

There are numerous benefits to obtaining a pre approval of home loan. Firstly, it provides you with a competitive edge in the housing market. Sellers are more likely to consider offers from buyers who have been pre-approved, as it demonstrates that you are a serious buyer with the financial backing to make a purchase. This can be especially important in a hot real estate market where homes are selling quickly.

Additionally, pre approval helps you identify any potential issues with your credit or financial situation before you make an offer on a home. If there are any discrepancies in your credit report or if your debt-to-income ratio is too high, you can address these issues before they become a barrier to your home purchase. This proactive approach can save you time and stress in the long run.

How to Obtain Pre Approval of Home Loan

The process of obtaining a pre approval of home loan typically involves several steps. Start by gathering your financial documents, including pay stubs, tax returns, and bank statements. Lenders will use this information to assess your financial health and determine your eligibility for a loan.

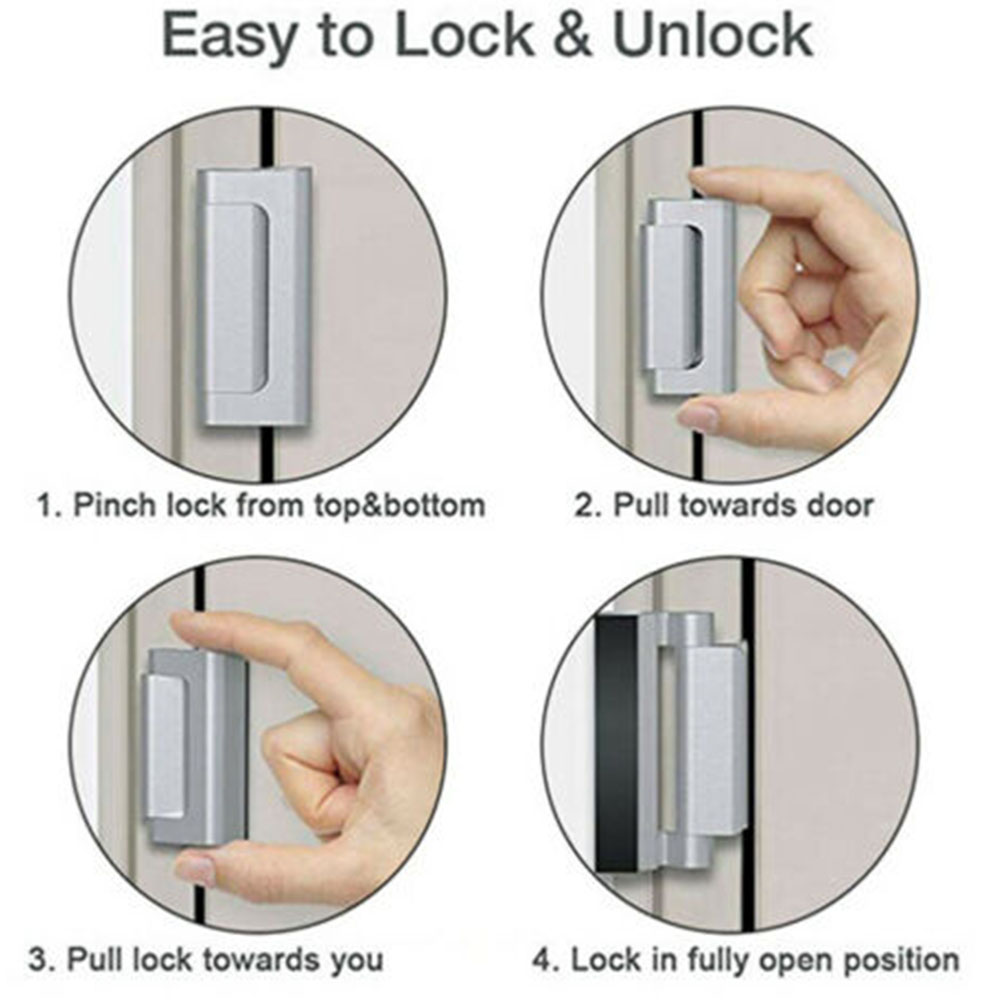

Once you have your documents ready, approach a lender or mortgage broker to begin the pre-approval process. They will review your financial information and run a credit check. If everything checks out, you will receive a pre-approval letter stating the amount you are qualified to borrow. This letter is usually valid for a set period, often 60 to 90 days, during which you can shop for homes.

Common Mistakes to Avoid During Pre Approval of Home Loan

While the pre approval of home loan can streamline your home buying process, there are common pitfalls that you should avoid. One of the biggest mistakes is not shopping around for the best lender. Different lenders may offer varying interest rates and terms, so it’s essential to compare multiple options to find the best deal.

Another mistake is failing to disclose all financial information to your lender. Be honest about your income, debts, and any other financial obligations. Withholding information can lead to issues later in the process, including denial of your loan application.

Lastly, avoid making major financial changes during the pre-approval period. This includes taking on new debts, changing jobs, or making large purchases. Such actions can impact your credit score and debt-to-income ratio, potentially jeopardizing your pre-approval status.

Conclusion: The Importance of Pre Approval of Home Loan

In conclusion, the pre approval of home loan is an essential step in the home buying journey. It not only clarifies your budget but also strengthens your position as a buyer in a competitive market. By understanding the benefits, the process, and the common mistakes to avoid, you can navigate this critical phase with confidence. Remember, being pre-approved is not just about securing a loan; it's about unlocking the door to your future home. Start your journey today by seeking pre approval and take the first step towards making your dream home a reality.