Can You Consolidate Private Loans into Federal Loans? Exploring Your Options for Student Loan Relief

Guide or Summary:Understanding Loan ConsolidationPrivate vs. Federal LoansCan You Consolidate Private Loans into Federal Loans?Options for Borrowers with Pr……

Guide or Summary:

- Understanding Loan Consolidation

- Private vs. Federal Loans

- Can You Consolidate Private Loans into Federal Loans?

- Options for Borrowers with Private Loans

- Considerations Before Consolidating

**Translation of the Title**: Can you consolidate private loans into federal loans

---

Understanding Loan Consolidation

Loan consolidation is a financial strategy that allows borrowers to combine multiple loans into a single loan with a new interest rate and repayment terms. This can simplify the repayment process and potentially lower monthly payments. However, when it comes to student loans, the options available can vary significantly between federal and private loans.

Private vs. Federal Loans

Before diving into the specifics of consolidation, it's essential to understand the differences between private and federal student loans. Federal loans are funded by the government and often come with benefits such as income-driven repayment plans, loan forgiveness programs, and deferment options. Private loans, on the other hand, are issued by private lenders and typically lack these borrower-friendly features.

Can You Consolidate Private Loans into Federal Loans?

The short answer is no; you cannot directly consolidate private loans into federal loans. Federal loan consolidation is available only for federal student loans. However, this does not mean that borrowers with private loans have no options.

Options for Borrowers with Private Loans

If you have private loans and are seeking relief, here are some potential pathways:

1. **Refinancing**: One option is to refinance your private loans with a new lender. This can potentially lower your interest rate and monthly payments. However, refinancing does not convert your private loans into federal loans, and you may lose any borrower benefits associated with your original loans.

2. **Federal Loan Consolidation**: If you have both federal and private loans, you can consolidate your federal loans through a Direct Consolidation Loan. This will not affect your private loans, but it can simplify your federal loan repayment.

3. **Income-Driven Repayment Plans**: If you have federal loans, you may qualify for income-driven repayment plans, which can significantly reduce your monthly payments based on your income and family size. While this option is not available for private loans, it can provide relief for federal loan borrowers.

4. **Loan Forgiveness Programs**: Certain professions qualify for federal loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF). If you have federal loans, you can explore these options to potentially have your loans forgiven after meeting specific criteria.

Considerations Before Consolidating

Before making any decisions regarding consolidation or refinancing, it’s crucial to assess your financial situation. Consider the following:

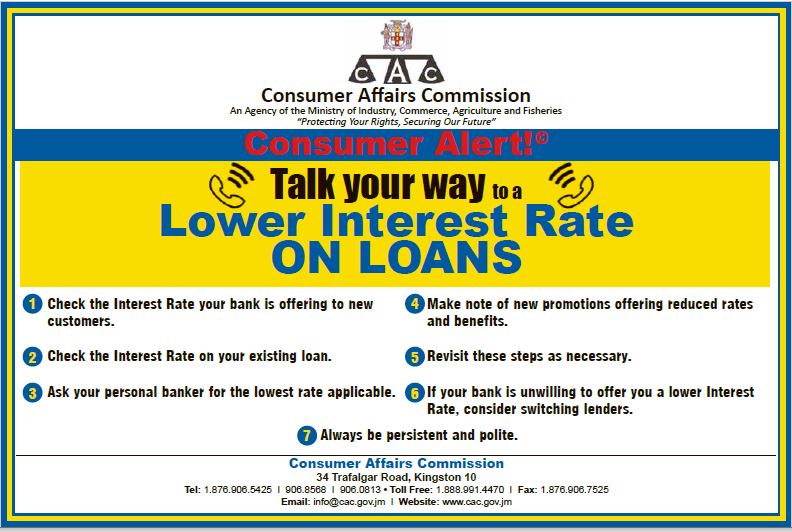

- **Interest Rates**: Compare the interest rates of your current loans with potential new loans. A lower interest rate can save you money in the long run.

- **Loan Terms**: Understand the terms of any new loans, including repayment periods and fees.

- **Benefits**: Weigh the benefits of federal loans against private loans. If you consolidate federal loans, you may lose certain benefits, so it’s essential to consider this before proceeding.

In summary, while you cannot consolidate private loans into federal loans, there are various strategies available for managing your student debt. Understanding the distinction between private and federal loans is crucial for making informed financial decisions. If you’re considering consolidation or refinancing, take the time to research your options and consult with a financial advisor to develop a plan that best suits your needs.