Understanding Are Mortgage Loans Simple Interest: Key Insights and Implications for Borrowers

#### Are Mortgage Loans Simple InterestWhen exploring the world of finance, particularly in relation to home buying, one question often arises: **Are mortga……

#### Are Mortgage Loans Simple Interest

When exploring the world of finance, particularly in relation to home buying, one question often arises: **Are mortgage loans simple interest?** This inquiry is crucial for potential homeowners and investors to understand the nature of their financial commitments.

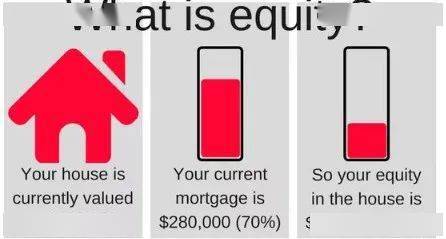

Mortgage loans are typically structured as amortized loans, meaning they involve both principal and interest payments over time. However, the concept of simple interest is often misunderstood in this context. Simple interest is calculated only on the principal amount of the loan, while most mortgage loans utilize compound interest, where interest accrues on both the principal and previously accumulated interest.

#### Understanding Mortgage Loan Structures

To fully grasp the implications of the question, it is essential to delve into how mortgage loans are structured. A traditional mortgage is usually paid back over a period of 15 to 30 years. During this time, borrowers make monthly payments that cover both the interest and a portion of the principal. The interest rate can be fixed or variable, with fixed rates providing stability in monthly payments.

In contrast to simple interest loans, where the interest remains constant over the life of the loan, mortgage loans are designed to favor the lender in the early years. This means that a larger portion of the early payments goes toward interest rather than reducing the principal balance. As time progresses, the proportion allocated to the principal increases.

#### The Importance of Interest Rates

Interest rates play a significant role in determining the overall cost of a mortgage. A lower interest rate can lead to substantial savings over the life of the loan. Borrowers should shop around and compare rates from different lenders to secure the best deal. Understanding whether a loan is based on simple or compound interest is vital in this process.

#### Benefits and Drawbacks of Mortgage Loans

When considering a mortgage, borrowers should weigh the benefits and drawbacks. One of the primary advantages of mortgage loans is the ability to spread out payments over many years, making homeownership more accessible. Additionally, mortgage interest may be tax-deductible, providing further financial relief.

However, the drawbacks include the long-term commitment and the potential for financial strain if interest rates rise or if the borrower’s financial situation changes. Furthermore, the misconception that mortgage loans operate on a simple interest basis can lead to misunderstandings regarding payment structures and total repayment amounts.

#### Conclusion

In conclusion, the question **Are mortgage loans simple interest?** opens up a broader discussion about the nature of mortgage loans and their implications for borrowers. Understanding the differences between simple and compound interest, as well as the structure of mortgage payments, is crucial for making informed financial decisions.

Potential homeowners should conduct thorough research and consider consulting with financial advisors to navigate the complexities of mortgage loans. By doing so, they can ensure that they choose the right loan structure that aligns with their financial goals and capabilities.