Unlock Your Dream Car: How to Get Pre Approved Auto Loan with Ease

#### IntroductionGetting a new car can be an exciting yet daunting experience. One of the first steps in this journey is understanding how to **get pre appr……

#### Introduction

Getting a new car can be an exciting yet daunting experience. One of the first steps in this journey is understanding how to **get pre approved auto loan**. This process not only simplifies your car buying experience but also helps you better manage your finances. In this article, we’ll explore the benefits, steps, and tips for getting pre-approved for an auto loan.

#### What is a Pre Approved Auto Loan?

A pre-approved auto loan is a financing option that allows you to determine how much money a lender is willing to loan you before you start shopping for a vehicle. This pre-approval process involves a lender reviewing your credit history, income, and other financial factors to assess your eligibility for a loan. By securing a pre-approval, you’ll have a clear understanding of your budget and can confidently negotiate with dealerships.

#### Benefits of Getting Pre Approved for an Auto Loan

1. **Know Your Budget**: When you get pre approved auto loan, you’ll receive a specific loan amount based on your financial situation. This helps you narrow down your car options and avoid overspending.

2. **Stronger Negotiating Power**: Being pre-approved gives you an advantage when negotiating with car dealers. It shows that you are a serious buyer with financing already in place, which can lead to better deals and lower interest rates.

3. **Faster Purchase Process**: With a pre-approved loan, the paperwork is already done, making the car purchasing process quicker and more efficient. You can focus on finding the right vehicle rather than worrying about financing.

4. **Improved Interest Rates**: Lenders often provide better interest rates to pre-approved borrowers, especially if you have good credit. This can save you a significant amount of money over the life of the loan.

#### Steps to Get Pre Approved for an Auto Loan

1. **Check Your Credit Score**: Before applying for pre-approval, check your credit score. This will give you an idea of what interest rates you might qualify for and help you identify any issues that need to be addressed.

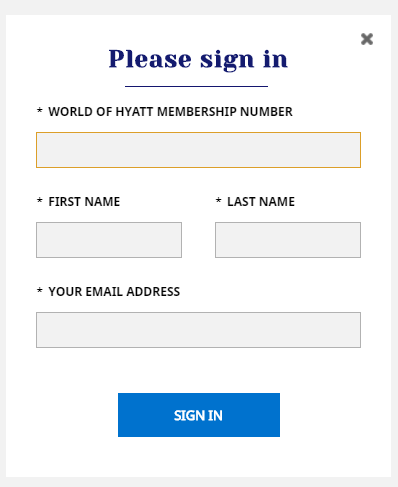

2. **Gather Financial Documents**: Prepare the necessary documentation, such as proof of income, employment verification, and any existing debts. This information will help lenders assess your financial situation more accurately.

3. **Research Lenders**: Look for lenders that offer pre-approved auto loans. This can include banks, credit unions, and online lenders. Compare their rates, terms, and customer reviews to find the best option for you.

4. **Submit Your Application**: Once you’ve chosen a lender, submit your application for pre-approval. This can often be done online for convenience. Be prepared to provide the financial documents you gathered earlier.

5. **Review Your Offer**: After your application is processed, the lender will provide you with a pre-approval offer. Review the loan amount, interest rate, and terms carefully. If you’re satisfied, you can proceed with your car search.

#### Tips for a Successful Pre-Approval Process

- **Avoid Major Financial Changes**: Try not to make significant purchases or change jobs while seeking pre-approval, as this can affect your financial stability and creditworthiness.

- **Consider Multiple Lenders**: Don’t settle for the first offer you receive. Getting pre-approved from multiple lenders can help you find the best interest rates and terms.

- **Ask Questions**: If you’re unsure about any part of the pre-approval process, don’t hesitate to ask the lender for clarification. Understanding the terms of your loan is crucial.

#### Conclusion

In conclusion, knowing how to **get pre approved auto loan** is a vital step in your car buying journey. It empowers you with knowledge about your budget, enhances your negotiating power, and streamlines the purchasing process. By following the steps outlined above and considering the benefits, you can confidently approach the car market and drive away in your dream vehicle. Remember, being pre-approved is not just about securing a loan; it’s about making informed financial decisions that benefit you in the long run.