Maximizing Your Financial Aid: A Comprehensive Guide to Grad Loan Plus for Graduate Students

#### Understanding Grad Loan PlusGrad Loan Plus, also known as the Graduate PLUS Loan, is a federal loan program designed specifically for graduate and prof……

#### Understanding Grad Loan Plus

Grad Loan Plus, also known as the Graduate PLUS Loan, is a federal loan program designed specifically for graduate and professional students. This loan can help cover the cost of your education, including tuition, fees, and living expenses. Unlike other federal loans, Grad Loan Plus is not based on financial need, allowing students to borrow up to the full cost of their education minus any other financial aid they receive.

#### Eligibility Requirements for Grad Loan Plus

To qualify for the Grad Loan Plus, students must be enrolled at least half-time in a graduate or professional program at an eligible institution. Additionally, applicants must complete the Free Application for Federal Student Aid (FAFSA) and meet general eligibility criteria, including being a U.S. citizen or eligible non-citizen and maintaining satisfactory academic progress.

#### Application Process for Grad Loan Plus

The application process for Grad Loan Plus is relatively straightforward. After completing the FAFSA, students must apply for the Grad PLUS Loan through their school's financial aid office. This includes submitting a separate application and undergoing a credit check. While a good credit history is not required, applicants with adverse credit may need to secure a creditworthy endorser.

#### Loan Limits and Interest Rates of Grad Loan Plus

The Grad Loan Plus allows students to borrow up to the total cost of attendance, which includes tuition, fees, and living expenses, minus any other financial aid received. As of the 2023-2024 academic year, the interest rate for Grad PLUS Loans is fixed at 7.54%. It is essential to note that interest accrues while you are in school, and repayment begins six months after graduation or when you drop below half-time enrollment.

#### Repayment Options for Grad Loan Plus

Repaying a Grad Loan Plus can be managed through various repayment plans, including standard, graduated, and income-driven repayment options. Standard repayment typically spans ten years, while income-driven plans adjust payments based on your income and family size. Additionally, borrowers may qualify for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), if they meet specific criteria.

#### Benefits of Grad Loan Plus

One of the main advantages of the Grad Loan Plus is the ability to cover a significant portion of educational expenses without the need for a co-signer. Furthermore, the fixed interest rate provides stability in repayment planning. The flexible repayment options also allow borrowers to choose a plan that best fits their financial situation.

#### Considerations Before Taking Out a Grad Loan Plus

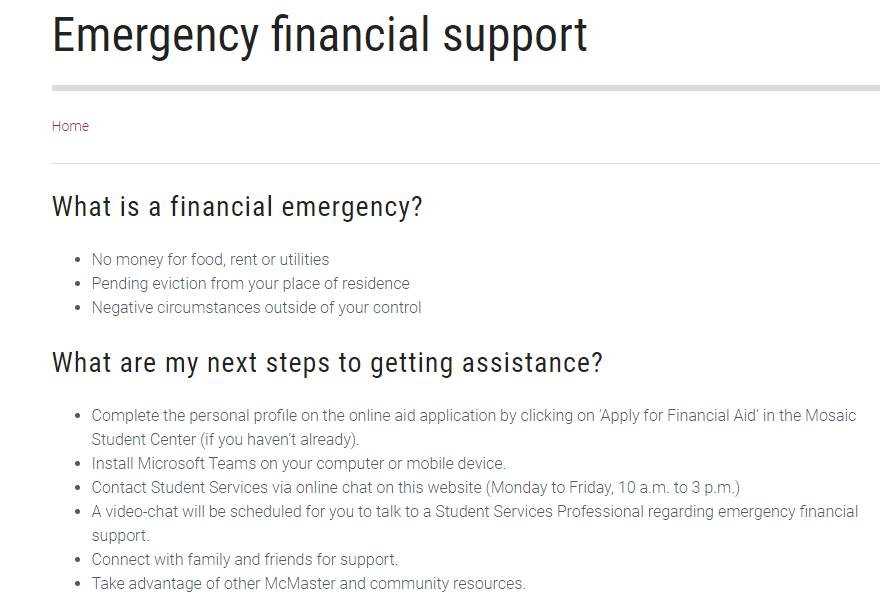

Before committing to a Grad Loan Plus, students should carefully consider the total amount they intend to borrow. While it may be tempting to borrow the maximum amount, it is crucial to assess future earning potential in your chosen field and how loan repayment will fit into your budget. Additionally, exploring other forms of financial aid, such as scholarships or assistantships, can help reduce the overall debt burden.

#### Conclusion: Making the Most of Your Grad Loan Plus

In conclusion, the Grad Loan Plus can be a valuable financial tool for graduate students looking to fund their education. By understanding the eligibility requirements, application process, and repayment options, students can make informed decisions about their borrowing. It is essential to weigh the benefits against potential long-term financial implications to ensure that your educational investment pays off in the future.