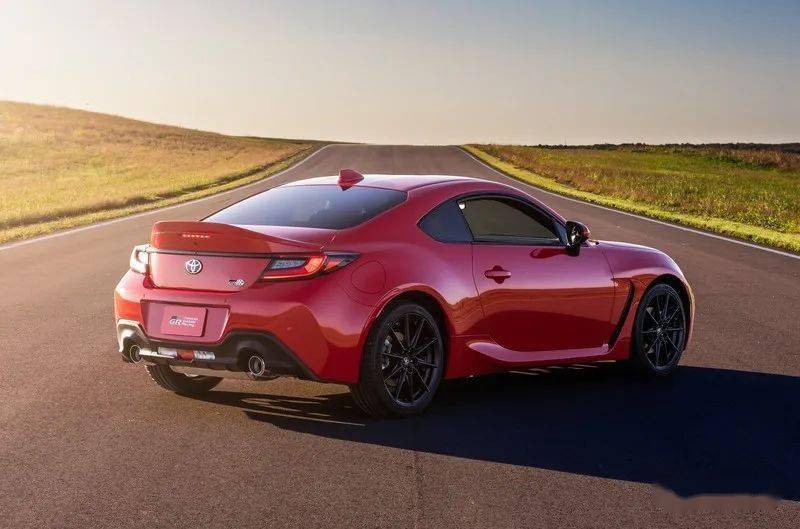

Comprehensive Guide to Using a Car Loan Estimator with Tax for Your Next Vehicle Purchase

#### Understanding Car Loan Estimator with TaxA **car loan estimator with tax** is a valuable tool that helps potential car buyers calculate their monthly p……

#### Understanding Car Loan Estimator with Tax

A **car loan estimator with tax** is a valuable tool that helps potential car buyers calculate their monthly payments, including taxes, fees, and other costs associated with financing a vehicle. By inputting details such as the vehicle price, loan term, interest rate, and local tax rates, users can get a clear picture of what their financial commitment will look like.

#### The Importance of Using a Car Loan Estimator with Tax

When considering a car purchase, understanding the total cost of the loan is crucial. Many buyers focus solely on the vehicle's price and the interest rate, neglecting to factor in taxes and other fees. A **car loan estimator with tax** ensures that all these elements are considered, providing a more accurate monthly payment estimate. This can prevent unpleasant surprises down the road and help buyers budget more effectively.

#### How to Use a Car Loan Estimator with Tax

Using a **car loan estimator with tax** is straightforward. Here’s a step-by-step guide:

1. **Gather Necessary Information**: Before using the estimator, collect details such as the car's price, your down payment amount, the loan term (in months), and the interest rate you expect to receive. Additionally, find out the sales tax rate in your area, as this can vary significantly.

2. **Input Data into the Estimator**: Enter the gathered information into the estimator. Most online calculators will have fields for vehicle price, down payment, interest rate, loan term, and tax rate.

3. **Review Your Results**: After inputting your data, the estimator will provide an estimated monthly payment. Review this figure to ensure it aligns with your budget. The tool may also break down the total interest paid over the loan term and the total cost of the vehicle, including taxes.

4. **Adjust Variables as Needed**: If the estimated payment exceeds your budget, consider adjusting variables such as the down payment or loan term. You can also explore different vehicles or financing options to find a more suitable arrangement.

#### Benefits of Using a Car Loan Estimator with Tax

There are several benefits to using a **car loan estimator with tax**:

- **Budgeting**: It helps you understand what you can afford, making it easier to set a realistic budget for your car purchase.

- **Comparison Shopping**: By estimating payments for multiple vehicles or loan options, you can make informed comparisons that save you money.

- **Negotiation Power**: Having a clear understanding of your financing options allows you to negotiate better terms with dealerships or lenders.

- **Financial Planning**: Knowing the total cost, including taxes, helps in long-term financial planning, ensuring you’re not overextending yourself.

#### Common Mistakes to Avoid

While using a **car loan estimator with tax**, be aware of common pitfalls:

- **Ignoring Additional Costs**: Remember to factor in insurance, maintenance, and registration fees, which can significantly impact your overall budget.

- **Not Updating Tax Rates**: Ensure you have the most current tax rate for your area, as these can change and affect your calculations.

- **Relying Solely on Estimates**: While estimators are helpful, they are just that—estimates. Always consult with your lender for precise figures before making a commitment.

#### Conclusion

In summary, a **car loan estimator with tax** is an essential tool for anyone looking to finance a vehicle. By providing a comprehensive view of monthly payments, including taxes, it allows buyers to make informed decisions. Whether you're a first-time buyer or looking to upgrade your vehicle, utilizing this estimator can lead to smarter financial choices and a more satisfying car-buying experience.