Understanding the Average House Loan Interest: What Homebuyers Need to Know in 2023

Guide or Summary:What is Average House Loan Interest?Factors Influencing Average House Loan Interest RatesThe Importance of Knowing the Average House Loan I……

Guide or Summary:

- What is Average House Loan Interest?

- Factors Influencing Average House Loan Interest Rates

- The Importance of Knowing the Average House Loan Interest

- Current Trends in Average House Loan Interest Rates

**Average House Loan Interest** (平均房屋贷款利率)

In the ever-evolving landscape of real estate, understanding the **average house loan interest** is crucial for prospective homebuyers and investors alike. As of 2023, the housing market has seen various fluctuations due to economic conditions, government policies, and shifts in consumer behavior. This article aims to provide a comprehensive overview of what the average house loan interest means, how it’s determined, and its implications for homebuyers.

What is Average House Loan Interest?

The **average house loan interest** refers to the typical interest rate that lenders charge for mortgage loans. This rate can vary significantly depending on various factors, including the borrower’s credit score, the type of loan, the loan term, and the overall economic climate. Generally, the average house loan interest is expressed as an annual percentage rate (APR), which includes not only the interest but also any associated fees.

Factors Influencing Average House Loan Interest Rates

Several factors contribute to the determination of the **average house loan interest**:

1. **Economic Indicators**: The overall health of the economy plays a significant role in interest rates. When the economy is strong, demand for loans increases, which can drive up interest rates. Conversely, during economic downturns, rates may decrease to encourage borrowing.

2. **Federal Reserve Policies**: The Federal Reserve (the central bank of the United States) influences interest rates through its monetary policy. When the Fed raises or lowers the federal funds rate, it indirectly affects the **average house loan interest** rates.

3. **Borrower’s Credit Profile**: Lenders assess the risk associated with lending to a borrower. A higher credit score typically results in lower interest rates, as the borrower is deemed less risky.

4. **Loan Type and Term**: Different types of loans (fixed-rate, adjustable-rate, etc.) and their terms (15-year, 30-year) also impact the average house loan interest. Fixed-rate loans usually have higher initial rates compared to adjustable-rate mortgages, which may start lower but can fluctuate over time.

The Importance of Knowing the Average House Loan Interest

For homebuyers, understanding the **average house loan interest** is essential for several reasons:

- **Budgeting**: Knowing the average interest rate can help buyers estimate their monthly mortgage payments and overall affordability. This knowledge is crucial in determining how much house they can realistically afford.

- **Timing the Market**: Interest rates can fluctuate based on market conditions. By staying informed about the average rates, buyers can make strategic decisions about when to purchase a home.

- **Negotiating Power**: When buyers are aware of the current average rates, they can negotiate better terms with lenders. This knowledge empowers them to shop around for the best possible mortgage deal.

Current Trends in Average House Loan Interest Rates

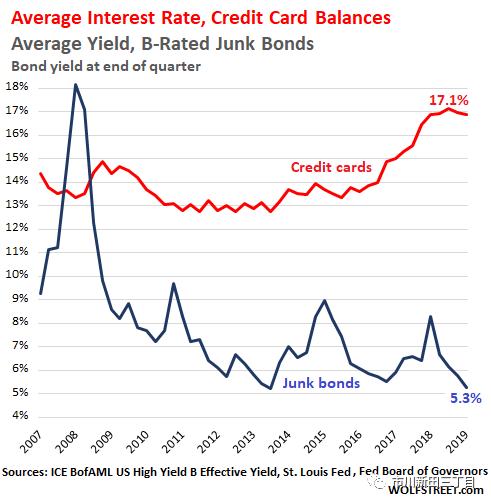

As of 2023, the **average house loan interest** rates have seen significant changes. With inflation concerns and adjustments in the Federal Reserve's policies, rates have risen compared to previous years. Homebuyers should be aware of these trends and consider locking in rates when they are favorable.

In conclusion, understanding the **average house loan interest** is vital for anyone looking to buy a home. By considering the factors that influence these rates and staying informed about current trends, prospective buyers can make more informed decisions and potentially save thousands over the life of their mortgage. Whether you are a first-time homebuyer or an experienced investor, knowledge of average interest rates is a critical component of your home-buying strategy.