"Understanding Loan Debt: Strategies to Manage and Overcome Financial Burdens"

#### What is Loan Debt?Loan debt refers to the amount of money borrowed from financial institutions or lenders that must be repaid with interest over time……

#### What is Loan Debt?

Loan debt refers to the amount of money borrowed from financial institutions or lenders that must be repaid with interest over time. This type of debt can arise from various sources, including student loans, personal loans, credit cards, mortgages, and auto loans. Understanding the nature of loan debt is crucial for anyone looking to manage their finances effectively.

#### The Impact of Loan Debt on Financial Health

Loan debt can significantly impact an individual’s financial health. High levels of debt can lead to stress, anxiety, and even affect mental health. It can restrict your ability to save for the future, invest in opportunities, or make significant purchases, such as a home or a car. Moreover, the burden of loan debt can affect your credit score, making it more challenging to secure additional loans or favorable interest rates in the future.

#### Types of Loan Debt

There are several types of loan debt, each with its own terms, interest rates, and repayment conditions.

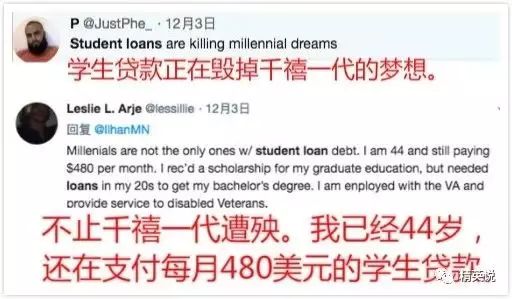

1. **Student Loans**: These are loans taken out to pay for education expenses. They often come with lower interest rates and flexible repayment plans. However, they can accumulate significantly over time, especially if not managed properly.

2. **Credit Card Debt**: This is a form of revolving debt that can quickly escalate if not paid off promptly. Credit cards often have high-interest rates, making it crucial to pay off the balance monthly to avoid accruing more debt.

3. **Personal Loans**: These loans are typically unsecured and can be used for various purposes, from consolidating debt to funding a large purchase. They usually have fixed interest rates and repayment terms.

4. **Mortgages**: A mortgage is a loan specifically for purchasing real estate. These loans are secured by the property itself, meaning if you fail to repay, the lender can take possession of the home.

5. **Auto Loans**: These loans are used to purchase vehicles and are typically secured by the car itself.

#### Strategies to Manage Loan Debt

Managing loan debt effectively requires a strategic approach. Here are some strategies to consider:

1. **Create a Budget**: Establish a monthly budget that accounts for all income and expenses. This will help you identify how much money can be allocated to debt repayment.

2. **Prioritize Payments**: Focus on paying off high-interest debt first, such as credit card debt, while making minimum payments on other loans. This strategy can save you money in the long run.

3. **Consider Debt Consolidation**: If you have multiple loans, consolidating them into a single loan with a lower interest rate can simplify payments and reduce overall interest costs.

4. **Negotiate with Lenders**: Don’t hesitate to reach out to your lenders to discuss your situation. They may offer lower interest rates, deferment options, or alternative repayment plans.

5. **Increase Income**: Look for ways to increase your income, whether through a part-time job, freelance work, or selling unused items. Extra income can be directed towards paying down debt.

6. **Seek Professional Help**: If managing loan debt becomes overwhelming, consider consulting with a financial advisor or credit counselor. They can provide personalized strategies and support.

#### Conclusion

Loan debt can be a significant burden, but with the right strategies and a proactive approach, it is possible to manage and overcome it. Understanding the different types of loan debt, their impact on financial health, and effective management techniques can empower individuals to take control of their financial future. Remember, the key to overcoming loan debt lies in planning, discipline, and seeking help when needed.