"Maximize Your Home Investment: Understanding the Benefits of 3 Mortgage Loans"

#### 3 Mortgage LoansWhen it comes to financing a home, understanding the various options available is crucial. One of the most effective strategies for pur……

#### 3 Mortgage Loans

When it comes to financing a home, understanding the various options available is crucial. One of the most effective strategies for purchasing property is utilizing multiple mortgage loans, specifically **3 mortgage loans**. This approach can provide flexibility and financial leverage, allowing homeowners to maximize their investment.

#### Understanding Mortgage Loans

Before diving into the advantages of using **3 mortgage loans**, it’s essential to grasp what mortgage loans are. A mortgage loan is a type of loan specifically used to purchase real estate. The property itself serves as collateral, which means that if the borrower defaults on the loan, the lender can take possession of the property.

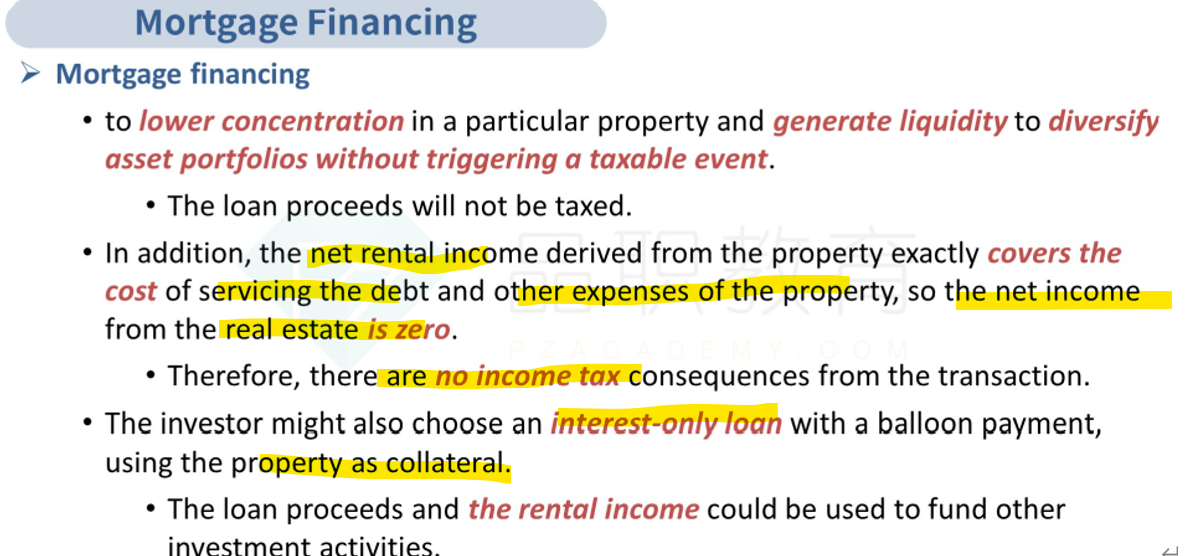

There are various types of mortgage loans, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), and interest-only loans. Each type has its own set of features, benefits, and risks. By understanding these different types, borrowers can better navigate their options when considering **3 mortgage loans**.

#### Advantages of Using 3 Mortgage Loans

1. **Increased Purchasing Power**: One of the primary benefits of utilizing **3 mortgage loans** is the potential for increased purchasing power. By spreading the financial burden across multiple loans, homeowners can afford properties that may have otherwise been out of reach. This can be particularly advantageous in competitive real estate markets where prices are on the rise.

2. **Diversification of Risk**: Using multiple mortgage loans can also help diversify risk. For instance, if one loan has a higher interest rate or less favorable terms, the impact on the homeowner’s overall financial situation may be mitigated by the other loans. This strategy can provide a safety net, especially in unpredictable economic climates.

3. **Tax Benefits**: Homeowners may also enjoy tax benefits when utilizing **3 mortgage loans**. Mortgage interest is often tax-deductible, which can lead to significant savings. By having multiple loans, homeowners can maximize their deductions, ultimately reducing their taxable income.

4. **Flexibility in Repayment**: Managing multiple loans can offer flexibility in repayment options. Homeowners can choose to pay off the loan with the highest interest rate first, or they can allocate funds based on their financial situation. This flexibility can be particularly beneficial for those who may experience fluctuating income or unexpected expenses.

5. **Building Equity**: By leveraging **3 mortgage loans**, homeowners may be able to build equity more quickly. As they pay down the principal on these loans, their ownership stake in the property increases. This equity can be tapped into for future investments or used as a financial cushion in times of need.

#### Considerations When Using 3 Mortgage Loans

While there are numerous benefits to using **3 mortgage loans**, it’s essential to approach this strategy with caution. Homeowners should consider their financial stability and ability to manage multiple payments. Additionally, interest rates and loan terms should be carefully evaluated to ensure that the overall cost of borrowing remains manageable.

It’s also advisable to consult with a financial advisor or mortgage specialist to assess the feasibility of this approach. They can provide insights into market conditions, loan options, and long-term financial planning.

#### Conclusion

In conclusion, utilizing **3 mortgage loans** can be a powerful strategy for those looking to invest in real estate. By understanding the various types of mortgage loans, their advantages, and the considerations involved, homeowners can make informed decisions that align with their financial goals. Whether you are a first-time homebuyer or an experienced investor, exploring the option of multiple mortgage loans could be the key to unlocking your dream property and maximizing your investment potential.