Maximize Your Financial Planning with a Free Online Loan Calculator

Guide or Summary:Introduction to Free Online Loan CalculatorBenefits of Using a Free Online Loan CalculatorHow to Use a Free Online Loan CalculatorTypes of……

Guide or Summary:

- Introduction to Free Online Loan Calculator

- Benefits of Using a Free Online Loan Calculator

- How to Use a Free Online Loan Calculator

- Types of Loans You Can Calculate

- Conclusion: Empower Your Financial Decisions

Introduction to Free Online Loan Calculator

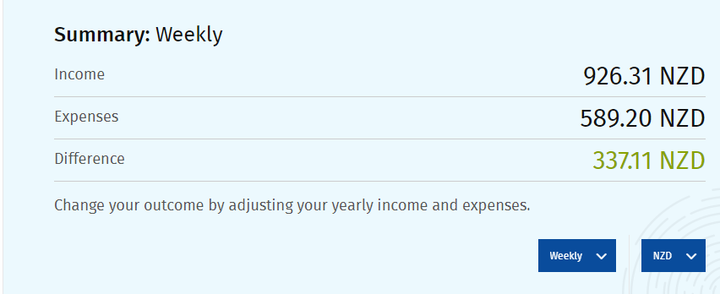

In today's fast-paced financial world, understanding your loan options is crucial. A **free online loan calculator** is an invaluable tool that helps individuals and businesses assess their borrowing needs and make informed decisions. By using this tool, you can easily calculate monthly payments, interest rates, and the total cost of loans, giving you a clearer picture of your financial commitments.

Benefits of Using a Free Online Loan Calculator

One of the primary advantages of a **free online loan calculator** is its accessibility. These calculators are typically available on various financial websites, allowing users to access them anytime and anywhere. With just a few clicks, you can input your loan amount, interest rate, and repayment term to receive instant results. This immediate feedback is particularly useful for those who are comparing different loan options and need to understand how changes in interest rates or loan terms will affect their payments.

Moreover, a **free online loan calculator** can help you budget effectively. By knowing your monthly payment obligations in advance, you can plan your finances better, ensuring you have enough funds to cover your living expenses while repaying your loan. This proactive approach can prevent potential financial strain in the future.

How to Use a Free Online Loan Calculator

Using a **free online loan calculator** is straightforward. Start by visiting a reputable financial website that offers this tool. Once there, you will typically find fields to enter the following information:

1. **Loan Amount**: The total amount you wish to borrow.

2. **Interest Rate**: The annual percentage rate (APR) that the lender charges.

3. **Loan Term**: The duration over which you plan to repay the loan, usually expressed in months or years.

After entering these details, simply click the "Calculate" button. The calculator will provide you with your estimated monthly payment, total interest paid over the life of the loan, and the total amount to be repaid. Some calculators even offer an amortization schedule, which breaks down each payment into principal and interest components.

Types of Loans You Can Calculate

A **free online loan calculator** can be used for various types of loans, including:

- **Personal Loans**: Unsecured loans for personal expenses, such as medical bills or home improvements.

- **Mortgage Loans**: Loans specifically for purchasing real estate, where the property serves as collateral.

- **Auto Loans**: Financing for purchasing vehicles, often secured by the vehicle itself.

- **Student Loans**: Loans designed to cover educational expenses, which may have different repayment options.

Each type of loan may have different terms and conditions, and a **free online loan calculator** can help you understand how these factors influence your repayment strategy.

Conclusion: Empower Your Financial Decisions

In conclusion, a **free online loan calculator** is a powerful tool that can significantly enhance your financial planning. By allowing you to simulate different loan scenarios, it empowers you to make informed decisions that align with your financial goals. Whether you're considering a personal loan, mortgage, or any other type of financing, using a loan calculator can provide clarity and confidence in your financial choices. Start using a **free online loan calculator** today and take the first step towards smarter financial management!