Understanding the Role of Loan Insurance in the NYT Crossword Puzzle

#### Loan InsuranceLoan insurance is a financial product that provides protection to lenders against the risk of default by borrowers. This type of insuranc……

#### Loan Insurance

Loan insurance is a financial product that provides protection to lenders against the risk of default by borrowers. This type of insurance is crucial in the lending industry, as it allows lenders to mitigate potential losses that can arise when a borrower fails to repay their loan. Loan insurance can take various forms, including mortgage insurance, credit insurance, and other types of guarantees that ensure the lender is compensated in the event of a default.

#### Org

In the context of loan insurance, "org" often refers to organizations that provide these insurance products or regulatory bodies that oversee them. These organizations play a vital role in the lending ecosystem, ensuring that both lenders and borrowers understand their rights and responsibilities. They also promote transparency and fairness in the lending process, contributing to a more stable financial environment.

#### NYT Crossword

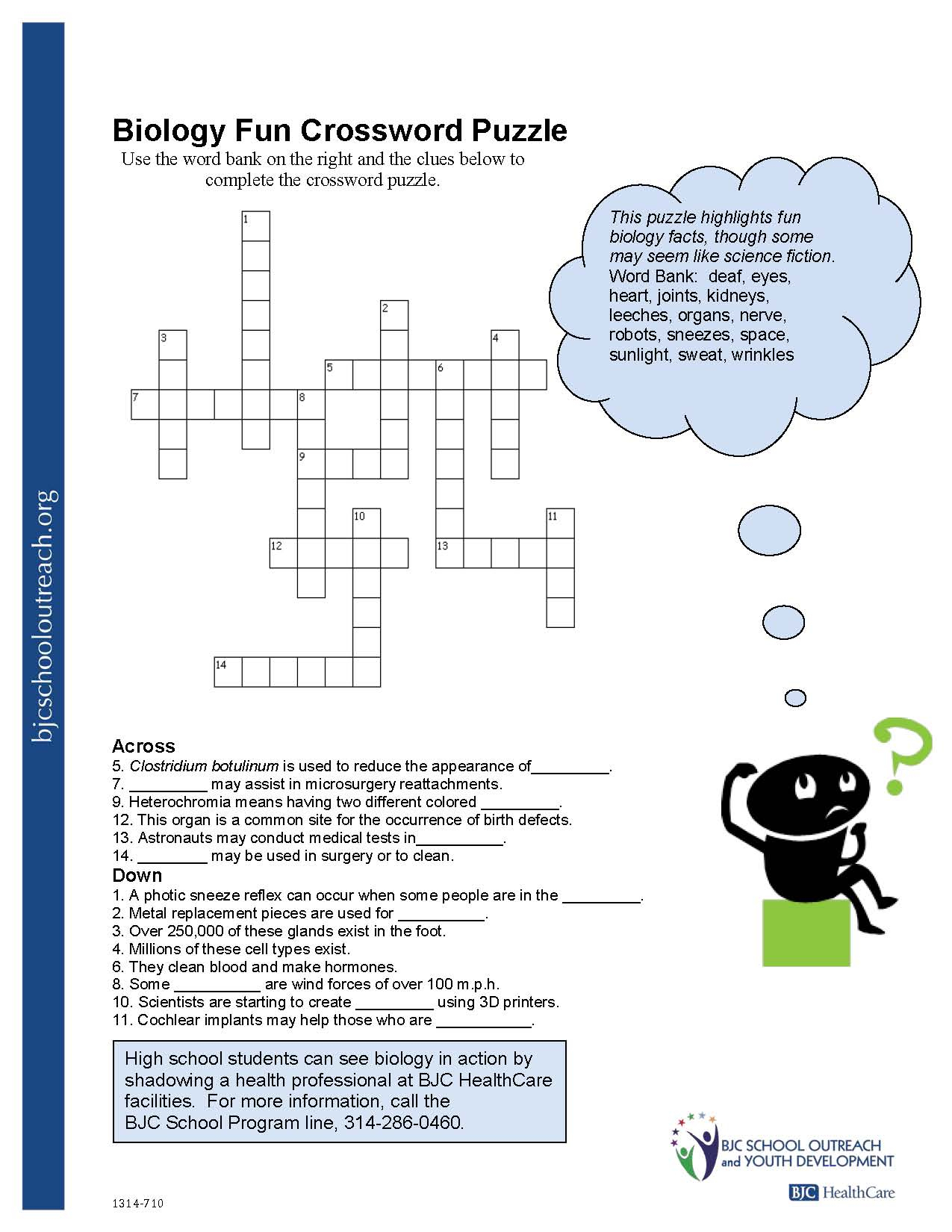

The New York Times (NYT) crossword puzzle is one of the most popular and challenging word games available. It features a wide range of clues and answers, often reflecting current events, cultural references, and various fields of knowledge. The inclusion of terms like "loan insurance" in the crossword puzzle highlights the intersection of finance and popular culture, making complex financial concepts accessible to a broader audience.

### Detailed Description

Loan insurance serves a critical purpose in the lending industry by protecting lenders from the financial repercussions of borrower defaults. When individuals or businesses take out loans, they often face various risks that could prevent them from meeting their repayment obligations. Loan insurance acts as a safety net, providing lenders with a degree of security.

One of the most common forms of loan insurance is mortgage insurance, which is typically required for homebuyers who make a down payment of less than 20% of the home's purchase price. This insurance protects lenders in the event that the borrower defaults on their mortgage. It allows more people to access home financing, as it reduces the risk for lenders and encourages them to approve loans that they might otherwise deem too risky.

Organizations that provide loan insurance are essential in this process. These entities not only offer insurance products but also help educate borrowers about their options and the implications of taking out loans. They ensure that borrowers are aware of the costs associated with loan insurance and how it can impact their overall financial situation. Additionally, regulatory organizations oversee these practices to protect consumers and maintain the integrity of the lending industry.

The connection between loan insurance and the NYT crossword puzzle may seem indirect, but it illustrates how financial literacy is becoming increasingly important in everyday life. Crossword puzzles often include clues related to finance, economics, and business, encouraging players to engage with these concepts in a fun and challenging way. By including terms like "loan insurance," the NYT crossword not only entertains but also educates its audience about essential financial topics.

In conclusion, understanding loan insurance is crucial for both lenders and borrowers. It plays a significant role in the lending process, providing security and promoting responsible borrowing. Organizations that offer loan insurance contribute to a more informed consumer base, while platforms like the NYT crossword puzzle help demystify complex financial concepts, making them accessible to a wider audience. As financial literacy continues to gain importance in our society, the interplay between loan insurance and popular culture will likely remain a relevant topic of discussion.