Credit Card Debt vs Personal Loan Debt: A Comprehensive Comparison

Guide or Summary:Interest Rates and FeesTerms and Repayment StrategiesEligibility and Approval ProcessesImpact on Credit ScoreCredit card debt and personal……

Guide or Summary:

- Interest Rates and Fees

- Terms and Repayment Strategies

- Eligibility and Approval Processes

- Impact on Credit Score

Credit card debt and personal loan debt are two common financial challenges that many individuals face. Both can have significant impacts on your financial health and overall well-being. Understanding the differences between credit card debt and personal loan debt is crucial for making informed decisions about your finances. In this article, we'll delve into a comprehensive comparison of credit card debt vs personal loan debt, covering key aspects such as interest rates, fees, terms, and repayment strategies.

Interest Rates and Fees

One of the most significant differences between credit card debt and personal loan debt lies in the interest rates and fees associated with each type of debt. Credit card debt typically comes with higher interest rates compared to personal loans. Credit card interest rates can vary significantly, but they often range from 15% to 25% or more. Personal loan interest rates, on the other hand, tend to be lower, typically ranging from 5% to 10% or less, depending on your credit score and other factors.

In addition to interest rates, credit card debt often comes with a range of fees, including annual fees, late payment fees, and balance transfer fees. Personal loans, on the other hand, usually have fewer fees and typically only charge interest.

Terms and Repayment Strategies

The terms and repayment strategies for credit card debt and personal loan debt also differ significantly. Credit card debt is often characterized by a revolving credit line, meaning you can keep borrowing as long as you make minimum payments. This can lead to a cycle of debt if you're not careful, as the balance can continue to grow if you don't pay it off in full each month.

Personal loans, on the other hand, are typically fixed-term loans with a set repayment schedule. This means you know exactly how much you need to repay each month and over what period, making it easier to budget and plan for your repayments.

Eligibility and Approval Processes

The eligibility and approval processes for credit card debt and personal loan debt also differ. Credit card debt is often easier to obtain, as most people can apply for a credit card regardless of their credit score. However, the interest rates and terms can vary significantly based on your creditworthiness.

Personal loans, on the other hand, typically require a more rigorous approval process. Lenders will assess your credit score, income, employment history, and other factors before deciding whether to approve your loan application. This can make it more challenging to obtain a personal loan, but it also means that the interest rates and terms can be more favorable.

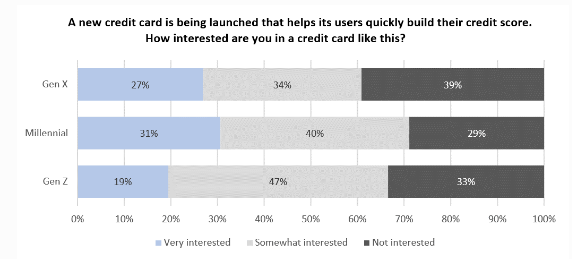

Impact on Credit Score

The impact of credit card debt and personal loan debt on your credit score can also differ. Credit card debt can have a significant impact on your credit score if you carry a high balance or make late payments. However, responsibly managing your credit card debt and making timely payments can actually improve your credit score over time.

Personal loans, on the other hand, can have a more neutral impact on your credit score. While taking out a personal loan can increase your overall debt, responsibly managing your repayments and paying off the loan on time can help maintain or even improve your credit score.

In conclusion, understanding the differences between credit card debt and personal loan debt is essential for making informed financial decisions. While both types of debt can have significant impacts on your financial health, the interest rates, fees, terms, and repayment strategies can vary significantly. By carefully considering your options and making responsible financial choices, you can manage your debt effectively and work towards a healthier financial future.