"Cost of Loan: A Comprehensive Guide to Understanding the Full Financial Impact of Your Mortgage, Car Loan, and Personal Loan"

Guide or Summary:Cost of Loan Understanding the Financial Impact of Your Mortgage, Car Loan, and Personal LoanMortgage The Lifelong Financial CommitmentCar……

Guide or Summary:

- Cost of Loan Understanding the Financial Impact of Your Mortgage, Car Loan, and Personal Loan

- Mortgage The Lifelong Financial Commitment

- Car Loan The Rolling Cost of Your Wheels

- Personal Loan The Personal Finance Rollercoaster

- Cost of Loan: Navigating the Complexities

Cost of Loan Understanding the Financial Impact of Your Mortgage, Car Loan, and Personal Loan

In the modern financial landscape, loans are an integral part of our lives, whether it's for purchasing a home, a vehicle, or financing personal expenses. However, the cost of a loan extends far beyond the initial interest rate and monthly payments. This comprehensive guide will delve into the full financial impact of your mortgage, car loan, and personal loan, providing insights into hidden costs, the true cost of borrowing, and how to navigate the complexities of loan repayment.

Mortgage The Lifelong Financial Commitment

When it comes to mortgages, the cost of loan goes beyond the monthly mortgage payments. Homeownership comes with a host of additional expenses, including property taxes, homeowner's insurance, maintenance, and repairs. These costs can significantly impact your overall financial health. To minimize these expenses, it's crucial to factor in these additional costs when evaluating mortgage options. Additionally, understanding the amortization schedule and the impact of prepayment penalties can help you make informed decisions about your mortgage repayment strategy.

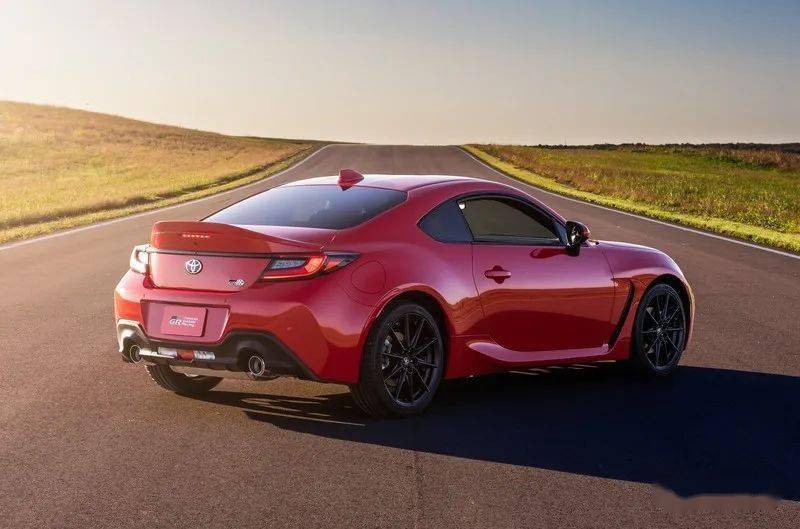

Car Loan The Rolling Cost of Your Wheels

Car loans are a common choice for financing the purchase of a vehicle. While the interest rate and monthly payments are the most obvious costs, don't overlook the fuel costs, maintenance, and insurance associated with car ownership. The true cost of a car loan also includes potential fees for late payments, prepayment penalties, and the potential for the car to depreciate in value. To manage these costs effectively, consider the total cost of ownership (TCO) when selecting a vehicle and financing options.

Personal Loan The Personal Finance Rollercoaster

Personal loans can be used for a variety of purposes, from consolidating debt to financing education or starting a business. While the interest rate and monthly payments are the primary concerns, personal loans often come with additional fees, including origination fees, prepayment fees, and late payment fees. These fees can add up quickly, significantly impacting your overall financial health. To navigate the complexities of personal loans, it's essential to read the fine print, understand the terms and conditions, and consider the long-term impact of your borrowing decisions.

Cost of Loan: Navigating the Complexities

Understanding the full financial impact of your mortgage, car loan, and personal loan requires a holistic approach. Start by doing your research and comparing loan options from multiple lenders. Consider the total cost of borrowing, including interest rates, fees, and additional expenses. Remember, the cost of loan is not just about the monthly payments but also includes the long-term financial implications of your borrowing decisions.

In conclusion, the cost of loan extends far beyond the initial interest rate and monthly payments. By understanding the full financial impact of your mortgage, car loan, and personal loan, you can make informed decisions that align with your financial goals. Remember, the key to successful loan repayment lies in careful planning, research, and a clear understanding of the true cost of borrowing. With this knowledge, you can navigate the complexities of loan repayment with confidence, ensuring a brighter financial future.