How Do You Assume a Loan: A Comprehensive Guide to Understanding Loan Assumption

Guide or Summary:How Do You Assume A LoanHow Do You Assume A Loan### Description:Assuming a loan can be an excellent financial strategy for individuals look……

Guide or Summary:

How Do You Assume A Loan

### Description:

Assuming a loan can be an excellent financial strategy for individuals looking to take over an existing mortgage or other types of loans. In this comprehensive guide, we will explore the intricacies of how do you assume a loan, the benefits and challenges associated with it, and the steps involved in the process. Whether you are a homebuyer considering a property with an assumable mortgage or a borrower looking to transfer your loan obligations, understanding the nuances of loan assumption is crucial.

#### What is Loan Assumption?

Loan assumption is a financial arrangement where one party takes over the responsibility of an existing loan from another party. In real estate, this typically occurs when a buyer takes over the seller's mortgage, allowing them to benefit from potentially lower interest rates or favorable loan terms. Not all loans are assumable, and the terms of the original loan agreement will dictate whether this option is available.

#### Why Consider Assuming a Loan?

1. **Lower Interest Rates**: In a rising interest rate environment, assuming a loan with a lower rate can save you significant money over the life of the loan.

2. **Reduced Closing Costs**: Assuming a loan often incurs fewer fees compared to obtaining a new mortgage, making it a cost-effective solution.

3. **Faster Process**: The process of assuming a loan can be quicker than applying for a new mortgage, especially if the lender is cooperative.

4. **Potentially Favorable Terms**: If the original borrower secured favorable terms, the new borrower can benefit from these terms without needing to negotiate a new loan.

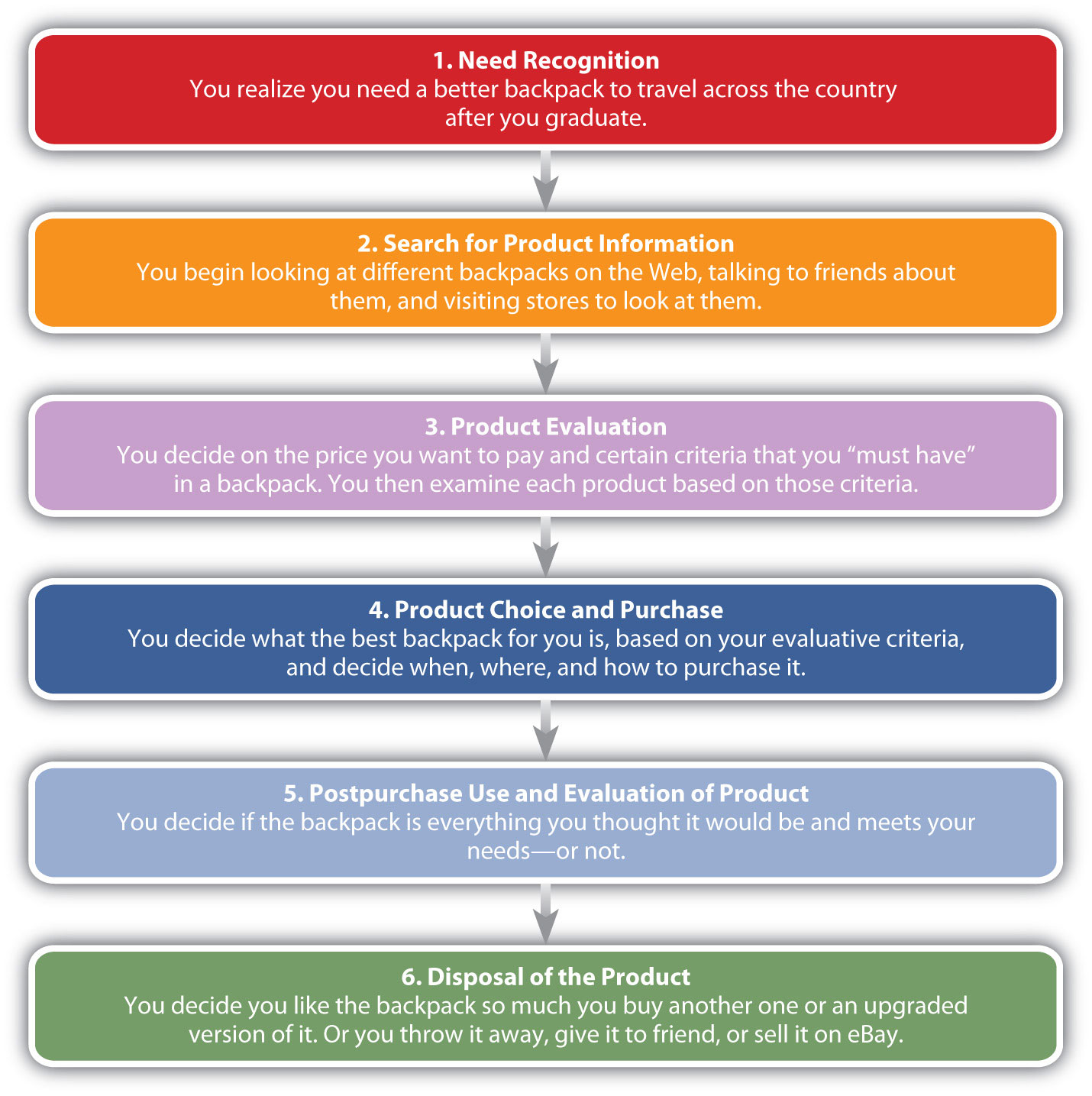

#### Steps to Assume a Loan

1. **Check Loan Assumability**: The first step in the process is to determine whether the loan is assumable. Review the loan documents or consult with the lender to understand the terms.

2. **Contact the Lender**: Once you confirm that the loan is assumable, reach out to the lender to express your interest in assuming the loan. They will provide you with the necessary information and requirements.

3. **Qualify for the Loan**: The lender may require you to meet certain qualifications, including creditworthiness and income verification. Be prepared to provide documentation that demonstrates your ability to repay the loan.

4. **Complete the Application Process**: If you meet the lender's qualifications, you will need to complete the application process. This may involve filling out forms and providing additional documentation.

5. **Review the Terms**: Before finalizing the assumption, carefully review the terms of the loan. Ensure that you understand the interest rate, payment schedule, and any other obligations.

6. **Finalize the Assumption**: Once everything is in order, you will sign the necessary paperwork to finalize the loan assumption. At this point, you will officially take over the loan and its associated payments.

#### Challenges of Loan Assumption

While assuming a loan can be beneficial, it is not without its challenges. Here are some potential drawbacks to consider:

1. **Limited Availability**: Not all loans are assumable, and even if they are, the lender may impose strict requirements.

2. **Due-on-Sale Clause**: Many loans come with a due-on-sale clause, which means that the lender can demand full repayment if the property is sold. This can complicate the assumption process.

3. **Potential Liability**: In some cases, the original borrower may remain liable for the loan even after the assumption, leading to potential complications if payments are missed.

4. **Credit Impact**: Assuming a loan can affect your credit score, especially if the original borrower had a lower credit score than you.

#### Conclusion

Understanding how do you assume a loan is essential for anyone considering this financial option. By weighing the benefits against the challenges and following the necessary steps, you can make an informed decision that aligns with your financial goals. Whether you are a buyer looking to save money or a seller wanting to make your property more attractive, loan assumption can be a powerful tool in your financial toolkit. Always consult with a financial advisor or mortgage professional to ensure that you are making the best choice for your unique situation.