Discover the Best Mortgage Loan Rates in Ohio: Your Ultimate Guide

Guide or Summary:Why Understanding Mortgage Loan Rates in Ohio MattersFactors Influencing Mortgage Loan Rates in OhioHow to Secure the Best Mortgage Loan Ra……

Guide or Summary:

- Why Understanding Mortgage Loan Rates in Ohio Matters

- Factors Influencing Mortgage Loan Rates in Ohio

- How to Secure the Best Mortgage Loan Rates in Ohio

- Final Thoughts on Mortgage Loan Rates in Ohio

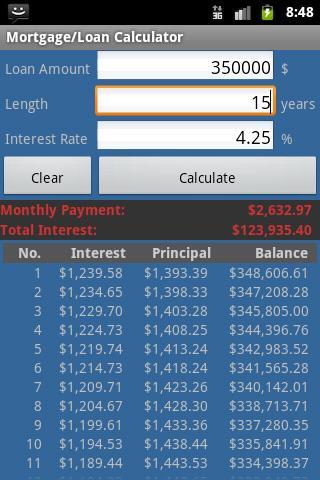

When it comes to purchasing a home in the Buckeye State, understanding mortgage loan rates Ohio is crucial for making informed financial decisions. Whether you are a first-time homebuyer or looking to refinance your existing mortgage, knowing the current rates can significantly impact your budget and long-term financial health.

In Ohio, mortgage loan rates can vary based on several factors, including your credit score, the type of loan you choose, and the lender you work with. As of now, the average mortgage loan rate in Ohio hovers around X%, but it’s important to note that this figure can fluctuate frequently due to market conditions. By staying informed, you can secure a rate that aligns with your financial goals.

Why Understanding Mortgage Loan Rates in Ohio Matters

Understanding mortgage loan rates Ohio not only helps you choose the right mortgage product but also enables you to budget effectively. A lower interest rate can save you thousands of dollars over the life of your loan, making it essential to shop around and compare offers from various lenders. Additionally, knowing the factors that influence these rates can empower you to make strategic decisions, such as improving your credit score or considering different loan types.

Factors Influencing Mortgage Loan Rates in Ohio

Several factors can influence mortgage loan rates Ohio, including:

1. **Credit Score**: Your credit score is one of the most significant determinants of the interest rate you will receive. Higher scores generally lead to lower rates.

2. **Loan Type**: Different types of loans, such as fixed-rate, adjustable-rate, or FHA loans, come with varying rates. Understanding the pros and cons of each can help you choose the best option for your situation.

3. **Down Payment**: The size of your down payment can also affect your mortgage rate. A larger down payment often results in a lower interest rate.

4. **Market Conditions**: Economic factors, such as inflation and the Federal Reserve's interest rate policies, can cause fluctuations in mortgage rates.

5. **Lender Policies**: Each lender may have different criteria and offers, so comparing multiple lenders is essential for finding the best rate.

How to Secure the Best Mortgage Loan Rates in Ohio

To secure the best mortgage loan rates Ohio, consider the following tips:

1. **Shop Around**: Don’t settle for the first offer you receive. Compare rates from multiple lenders to find the best deal.

2. **Improve Your Credit Score**: Take steps to enhance your credit score before applying for a mortgage. Pay down debts, make payments on time, and avoid taking on new debt.

3. **Consider Different Loan Types**: Research various loan options and their respective rates. A fixed-rate mortgage may offer stability, while an adjustable-rate mortgage may start with a lower rate.

4. **Negotiate**: Don’t hesitate to negotiate with lenders. If you have a better offer from another lender, use it as leverage to secure a lower rate.

5. **Lock in Your Rate**: Once you find a favorable rate, consider locking it in to protect yourself from potential increases during the closing process.

Final Thoughts on Mortgage Loan Rates in Ohio

Navigating the world of mortgage loan rates Ohio can be overwhelming, but with the right information and strategies, you can make informed decisions that benefit your financial future. By understanding the factors that affect rates and taking proactive steps to secure the best deal, you can turn your dream of homeownership into a reality. Always remember that knowledge is power—so equip yourself with the right tools to make the best choice for your needs.