Unlock Your Homeownership Dreams: Apply for FHA Loan Bad Credit

Guide or Summary:Understanding FHA LoansWhy Bad Credit Shouldn't Stop YouSteps to Apply for FHA Loan Bad CreditConclusion: Your Path to HomeownershipAre you……

Guide or Summary:

- Understanding FHA Loans

- Why Bad Credit Shouldn't Stop You

- Steps to Apply for FHA Loan Bad Credit

- Conclusion: Your Path to Homeownership

Are you dreaming of owning a home but worried that your bad credit will hold you back? You're not alone. Many potential homeowners face similar challenges, but there's good news! You can still achieve your dream of homeownership by learning how to apply for FHA loan bad credit options. The Federal Housing Administration (FHA) offers loans designed specifically for individuals with less-than-perfect credit, making it easier for you to secure financing and purchase your dream home.

Understanding FHA Loans

FHA loans are government-backed mortgages that allow borrowers to qualify with lower credit scores than traditional loans. This makes them an excellent option for first-time homebuyers or those who have experienced financial difficulties in the past. With an FHA loan, you can benefit from lower down payment requirements, which can be as low as 3.5% of the purchase price. This is a significant advantage for buyers who may not have substantial savings.

Why Bad Credit Shouldn't Stop You

Having bad credit can feel like a significant barrier when trying to secure a mortgage. However, FHA loans are designed to be more forgiving. While traditional lenders may require a credit score of 620 or higher, FHA lenders may approve loans for borrowers with scores as low as 500. This flexibility opens the door for many individuals and families who would otherwise be unable to qualify for a mortgage.

Steps to Apply for FHA Loan Bad Credit

1. **Check Your Credit Report**: Before applying, it's crucial to understand your credit situation. Obtain a copy of your credit report and check for any errors that could be negatively impacting your score. Disputing inaccuracies can help improve your credit standing.

2. **Improve Your Credit Score**: While FHA loans are accessible to those with bad credit, improving your score will enhance your chances of approval and may secure better terms. Pay off outstanding debts, make payments on time, and avoid taking on new debt.

3. **Gather Necessary Documentation**: Lenders will require various documents to process your FHA loan application. This typically includes proof of income, tax returns, bank statements, and information about your debts and assets.

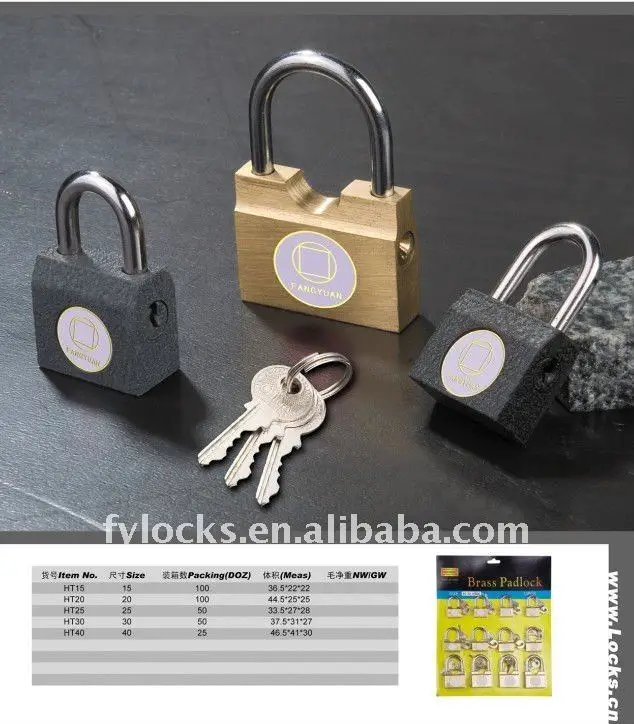

4. **Find a Lender**: Not all lenders offer FHA loans, so it's essential to find one that does and is willing to work with borrowers with bad credit. Research different lenders, compare their terms, and read customer reviews to find a reputable option.

5. **Submit Your Application**: Once you've chosen a lender, it's time to submit your application. Be prepared to answer questions about your financial history and provide any necessary documentation.

6. **Close the Deal**: If approved, you'll move on to the closing process, where you'll finalize the details of your loan and officially become a homeowner!

Conclusion: Your Path to Homeownership

Don't let bad credit deter you from pursuing your dream of owning a home. By understanding how to apply for FHA loan bad credit, you can take the first step toward homeownership. With the right preparation and guidance, you can navigate the process and secure the financing you need. Remember, many people have successfully turned their dreams into reality, and you can too! Start your journey today and explore the possibilities that await you with an FHA loan.