Business Loan vs Personal Loan: Which One is Right for You?

When it comes to financing your dreams, understanding the differences between a business loan vs personal loan is crucial. Both types of loans serve differe……

When it comes to financing your dreams, understanding the differences between a business loan vs personal loan is crucial. Both types of loans serve different purposes and come with their own sets of advantages and disadvantages. This guide will help you navigate the complexities of these two financing options, ensuring you make an informed decision tailored to your specific needs.

### What is a Business Loan?

A business loan is a type of financing specifically designed to help entrepreneurs and business owners fund their operational needs, expansion plans, or capital investments. These loans can be used for various purposes, such as purchasing equipment, hiring staff, or managing cash flow. Business loans typically come with higher amounts and longer repayment terms compared to personal loans, making them suitable for larger financial commitments.

### What is a Personal Loan?

On the other hand, a personal loan is an unsecured loan that individuals can use for a variety of personal expenses. This can include debt consolidation, medical bills, home improvements, or even funding a vacation. Personal loans usually have lower borrowing limits and shorter repayment periods than business loans, but they offer flexibility in how the funds can be used.

### Key Differences Between Business Loans and Personal Loans

1. **Purpose of the Loan**: The most significant difference lies in the intended use of the funds. A business loan vs personal loan comparison reveals that business loans are tailored for business-related expenses, while personal loans cater to individual financial needs.

2. **Eligibility Requirements**: Business loans often require a detailed business plan, financial statements, and proof of revenue, whereas personal loans typically focus on the individual's credit score and income. If you have a strong business history and can demonstrate your ability to repay, a business loan may be more accessible.

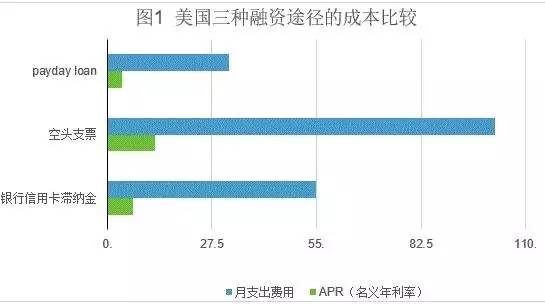

3. **Interest Rates**: Generally, business loans can have higher interest rates than personal loans, especially if the business is new or lacks a strong credit history. However, the rates can vary widely based on the lender and the borrower's creditworthiness.

4. **Tax Implications**: Interest paid on business loans may be tax-deductible, which can be a significant advantage for business owners. In contrast, personal loan interest is typically not tax-deductible, making business loans a more financially savvy choice for entrepreneurs.

5. **Impact on Credit Score**: Taking out a business loan vs personal loan can impact your credit score differently. Business loans are usually reported to business credit bureaus, while personal loans affect your personal credit score. It's essential to consider how each type of loan will influence your overall financial health.

### When to Choose a Business Loan

If you're looking to expand your business, invest in new equipment, or need working capital, a business loan might be the best option. These loans can provide the necessary funds to fuel growth and help you achieve your business goals.

### When to Choose a Personal Loan

Conversely, if you need funds for personal expenses, a personal loan is likely the better choice. It offers flexibility and can be a quick solution for urgent financial needs without the complexities of business lending.

### Conclusion

In summary, understanding the nuances of business loan vs personal loan is vital for making the right financial decision. Assess your needs, evaluate your financial situation, and consider the pros and cons of each option. By doing so, you can choose the financing solution that aligns best with your goals, whether for personal use or business growth. Always consult with a financial advisor or lender to explore your options and find the best rates and terms available.