Unlock Your Dream Home: Government Housing Loans for Disabled Individuals Made Easy

#### Description:Finding the perfect home can be a daunting task, especially for individuals with disabilities who may face unique challenges in the housing……

#### Description:

Finding the perfect home can be a daunting task, especially for individuals with disabilities who may face unique challenges in the housing market. Fortunately, government housing loans for disabled individuals provide a lifeline, making homeownership more accessible and affordable. This comprehensive guide will explore the various options available, the benefits of these loans, and how to navigate the application process.

**Understanding Government Housing Loans for Disabled Individuals**

The government recognizes the need for affordable housing solutions for individuals with disabilities. Various programs are in place to assist eligible applicants in securing a home. These loans often come with favorable terms, including lower interest rates and reduced down payment requirements, making them an attractive option for many.

**Types of Government Housing Loans for Disabled Individuals**

1. **FHA Loans**: The Federal Housing Administration (FHA) offers loans specifically designed for low-to-moderate-income individuals, including those with disabilities. FHA loans require a lower down payment, typically around 3.5%, and have more lenient credit score requirements.

2. **VA Loans**: For veterans with disabilities, the U.S. Department of Veterans Affairs (VA) provides loans that do not require a down payment and offer competitive interest rates. These loans are specifically tailored to support veterans in achieving homeownership.

3. **USDA Loans**: The U.S. Department of Agriculture (USDA) offers loans for individuals in rural areas, including those with disabilities. These loans often come with zero down payment options and are designed to promote homeownership in less populated regions.

4. **State and Local Programs**: Many states and local governments have their own housing programs aimed at assisting disabled individuals. These may include grants, low-interest loans, and other forms of financial assistance.

**Benefits of Government Housing Loans for Disabled Individuals**

- **Affordability**: One of the primary advantages of government housing loans for disabled individuals is their affordability. With lower interest rates and down payment requirements, these loans make it easier to purchase a home without breaking the bank.

- **Accessibility**: Many government programs are designed with accessibility in mind, ensuring that homes meet the needs of individuals with disabilities. This may include features such as ramps, wider doorways, and accessible bathrooms.

- **Support Services**: In addition to financial assistance, many programs offer support services, including counseling and resources to help disabled individuals navigate the home-buying process.

**Navigating the Application Process**

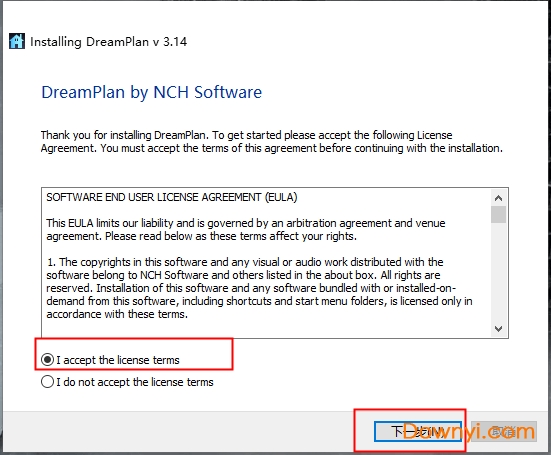

Applying for a government housing loan for disabled individuals can seem overwhelming, but understanding the steps involved can simplify the process:

1. **Research**: Start by researching the various loan options available to you. Determine which programs you qualify for based on your disability status, income, and location.

2. **Gather Documentation**: Collect the necessary documentation, including proof of disability, income statements, and credit history. This information will be crucial during the application process.

3. **Apply**: Once you have all your documents in order, submit your application to the chosen lender or government agency. Be prepared to answer questions about your financial situation and housing needs.

4. **Follow Up**: After submitting your application, stay in touch with your lender to ensure everything is progressing smoothly. Be proactive in addressing any additional information they may require.

**Conclusion**

In conclusion, government housing loans for disabled individuals are a valuable resource for those seeking to achieve homeownership. With various loan options available, each tailored to meet the unique needs of disabled individuals, the dream of owning a home is within reach. By understanding the benefits and navigating the application process, you can take significant steps toward securing your ideal living space. Don't let obstacles hold you back—explore your options today and unlock the door to your dream home!