Unlock Your Dream Car with the Ultimate Florida Auto Loan Calculator

Are you ready to drive away in your dream car while keeping your finances in check? The Florida Auto Loan Calculator is your essential tool for making infor……

Are you ready to drive away in your dream car while keeping your finances in check? The Florida Auto Loan Calculator is your essential tool for making informed decisions about your auto financing options. Whether you're a first-time buyer or looking to upgrade your current vehicle, understanding your budget is crucial. This comprehensive guide will explore how the Florida Auto Loan Calculator can help you navigate the exciting world of car loans, ensuring you get the best deal possible.

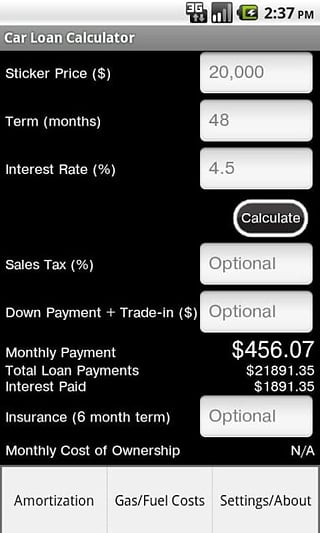

The Florida Auto Loan Calculator simplifies the auto loan process by allowing you to input key information such as the loan amount, interest rate, and loan term. With just a few clicks, you can see your estimated monthly payments, total interest paid, and even the overall cost of the loan. This transparency empowers you to make educated financial choices that align with your budget and lifestyle.

When using the Florida Auto Loan Calculator, it’s important to consider several factors that can affect your loan. Firstly, your credit score plays a significant role in determining the interest rates you qualify for. A higher credit score typically leads to lower interest rates, which can save you thousands over the life of your loan. If you’re unsure of your credit score, consider checking it before applying for a loan. This way, you can take steps to improve it if necessary, maximizing your chances of securing a favorable rate.

Another crucial factor is the loan term. While longer loan terms may seem appealing due to lower monthly payments, they often result in paying more interest over time. The Florida Auto Loan Calculator allows you to experiment with different loan terms, helping you find the perfect balance between manageable payments and overall loan cost. For instance, if you choose a 60-month loan instead of a 72-month loan, you might pay a slightly higher monthly payment but save on interest in the long run.

Additionally, don’t forget to factor in the down payment. A larger down payment reduces the amount you need to finance, which can lead to lower monthly payments and less interest paid over the life of the loan. The Florida Auto Loan Calculator can help you visualize how different down payment amounts impact your overall loan costs.

Once you've gathered all your information, using the Florida Auto Loan Calculator becomes a straightforward process. Input your desired loan amount, estimated interest rate, loan term, and down payment. With this data, the calculator will provide you with a detailed breakdown of your monthly payments, total interest, and total loan cost. This information is invaluable when negotiating with lenders or dealerships, as it gives you a clear picture of what you can afford.

Moreover, the Florida Auto Loan Calculator is not just a one-time tool; it can be used repeatedly as you refine your budget and explore different vehicles. Whether you're eyeing a brand-new model or a reliable used car, this calculator can adapt to your changing needs, ensuring you always have the latest financial insights at your fingertips.

In conclusion, the Florida Auto Loan Calculator is an indispensable resource for anyone looking to purchase a vehicle in Florida. By providing clarity on your financing options, it empowers you to make informed decisions that align with your financial goals. Don’t let the complexities of auto loans overwhelm you—leverage the power of the Florida Auto Loan Calculator to take control of your car-buying journey. Start calculating today, and drive confidently into your automotive future!