"Understanding the Pros and Cons of Taking a Loan from Your 401k: A Comprehensive Guide"

**Loan from your 401k** (从你的401k借款)#### IntroductionTaking a **loan from your 401k** can be a tempting option for many individuals facing financial challeng……

**Loan from your 401k** (从你的401k借款)

#### Introduction

Taking a **loan from your 401k** can be a tempting option for many individuals facing financial challenges. This financial strategy allows you to borrow against your retirement savings, providing immediate access to funds without the need for a credit check. However, it is essential to weigh the advantages and disadvantages before making such a significant decision. In this comprehensive guide, we will delve into the intricacies of borrowing from your retirement account, helping you understand how it works, its benefits, and potential pitfalls.

#### What is a Loan from Your 401k?

A **loan from your 401k** is essentially a way for you to access a portion of your retirement savings while still maintaining ownership of those funds. Most 401k plans allow participants to borrow a certain percentage of their vested balance, typically up to $50,000 or 50% of the account balance, whichever is less. The loan is repaid over a specified period, usually within five years, through payroll deductions.

#### Advantages of Taking a Loan from Your 401k

1. **No Credit Check Required**: One of the most significant benefits of a **loan from your 401k** is that it does not require a credit check. This can be particularly advantageous for those with poor credit scores or limited credit history.

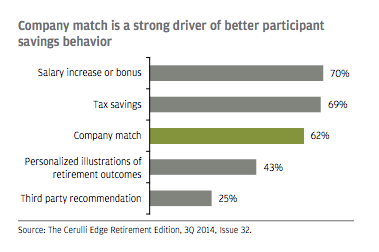

2. **Lower Interest Rates**: The interest rates on 401k loans are often lower than those of personal loans or credit cards. Additionally, the interest paid goes back into your account, essentially paying yourself.

3. **Flexible Repayment Terms**: Most 401k plans offer flexible repayment options, allowing you to repay the loan through payroll deductions, which can make it easier to manage.

4. **No Tax Penalties**: As long as you repay the loan within the specified timeframe, you won't incur any tax penalties or early withdrawal fees, which is a significant advantage compared to other forms of borrowing.

#### Disadvantages of Taking a Loan from Your 401k

1. **Potential for Reduced Retirement Savings**: Borrowing from your 401k can significantly impact your retirement savings. The money you take out will not be growing tax-deferred during the loan period, which can hinder your long-term financial goals.

2. **Risk of Job Loss**: If you leave your job or are terminated, the outstanding balance of your loan may become due immediately. If you cannot repay it, the remaining balance may be considered a distribution, leading to tax penalties.

3. **Limited Contributions**: While you are repaying the loan, many plans limit your ability to contribute to your 401k, further stunting your retirement growth.

4. **Psychological Factors**: Relying on your retirement savings for immediate financial needs can create a psychological barrier, leading to poor financial habits and reliance on future savings for current expenses.

#### Conclusion

In conclusion, a **loan from your 401k** can be a viable option for those in need of quick cash, but it is crucial to consider the long-term implications on your retirement savings. Weighing the pros and cons, understanding the terms of your plan, and considering alternative financing options can help you make an informed decision. If you decide to proceed, ensure that you have a solid repayment plan in place to safeguard your financial future. Always consult with a financial advisor to explore all available options and make the best choice for your unique situation.